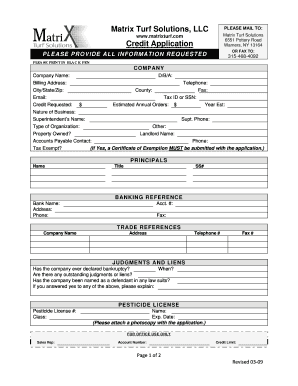

Get the free list of creditors template form

Get, Create, Make and Sign

How to edit list of creditors template online

How to fill out list of creditors template

How to fill out list of creditors template:

Who needs the list of creditors template:

Video instructions and help with filling out and completing list of creditors template

Instructions and Help about format creditor form pdf

Now we've just done your unsecured priority claims, and we've finishing meta here's where we're going to list all those claims, and we'll give the name and address of the creditors you know there's a number of rules on this, and I'll handle it I just need to know who they are, so I can list those properly now here's your big one Schedule F this will have the most number of pages in most consumer bankruptcies of any other schedule this is where we list all of your unsecured claims your credit card debts your hospital bills anybody else you might oh now I've undoubtedly pointed it out in a number of places in the tutorial but let me say it again the only creditors that are discharged are the creditors that we list in your bankruptcy and those that we send a notice to, so those are the two requirements, so it's real important that we get all your creditors we don't want to end up with one or two creditors who said well you didn't list me in the bankruptcy and or you didn't send me a notice, so you still owe me no we need to list everybody, and again I've pointed out let's say you're going to repay somebody, so you think well I just won't list them well know when you go to the 341 meeting you're going to be required to fill out a questionnaire under oath and that will always be one of the specific questions that you're asked is done you list all your creditors well you don't want to lie that's perjury, so you're going to list all your creditors now in a chapter 7 if you want to repay any creditor after we file you can certainly do that, but they need to be listed in Schedule F even if you intend to repay them now on Schedule F for chapter 13 you can't do that because you're paying your unsecured creditors through a chapter 13 plan, and you can't show favoritism to any one of them so watch the video on the exemptions and what be sure to go through the series on competing interests its like there's a number of chess games going on at the same time in a consumer bankruptcy but the important thing I want you to get out of this right now is we need to list every creditor that you've got, so again we're going to list the last four digits of whatever the account number is with that creditor if you have a code debtor how who incurred the dead you or your wife or both of you the date the claim was incurred in the consideration there are rules for completing this form in the video that I provide to my clients I'll give you all those rules so that you can help me get all this accurately unexpired leases and execute ORI contracts executor is a word that we don't use in everyday English, so you think what gosh what's that well let me give you it's easier for me to explain it by examples let's say that you have an apartment that you're renting well you've got a rental agreement with your landlord well that's an executor e contract it means that performance is largely incomplete on both sides if you've got a rent-to-own agreement on furniture appliances or...

Fill creditors list example : Try Risk Free

People Also Ask about list of creditors template

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your list of creditors template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.